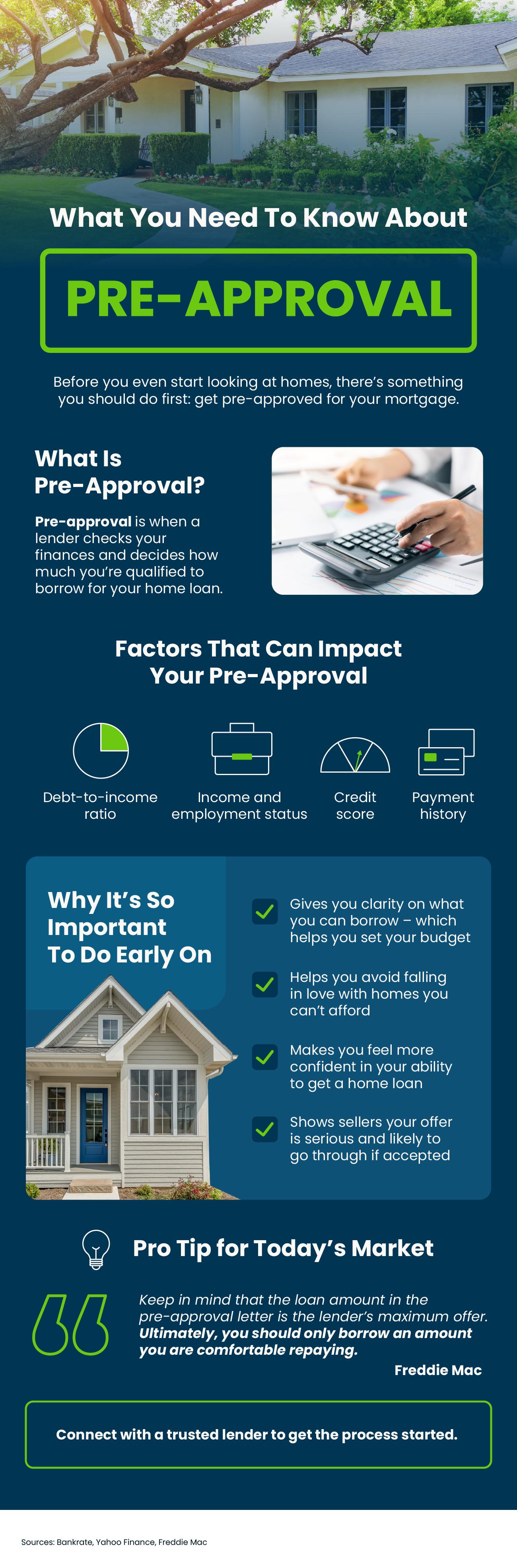

What You Need To Know About Pre-Approval

Some Highlights

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

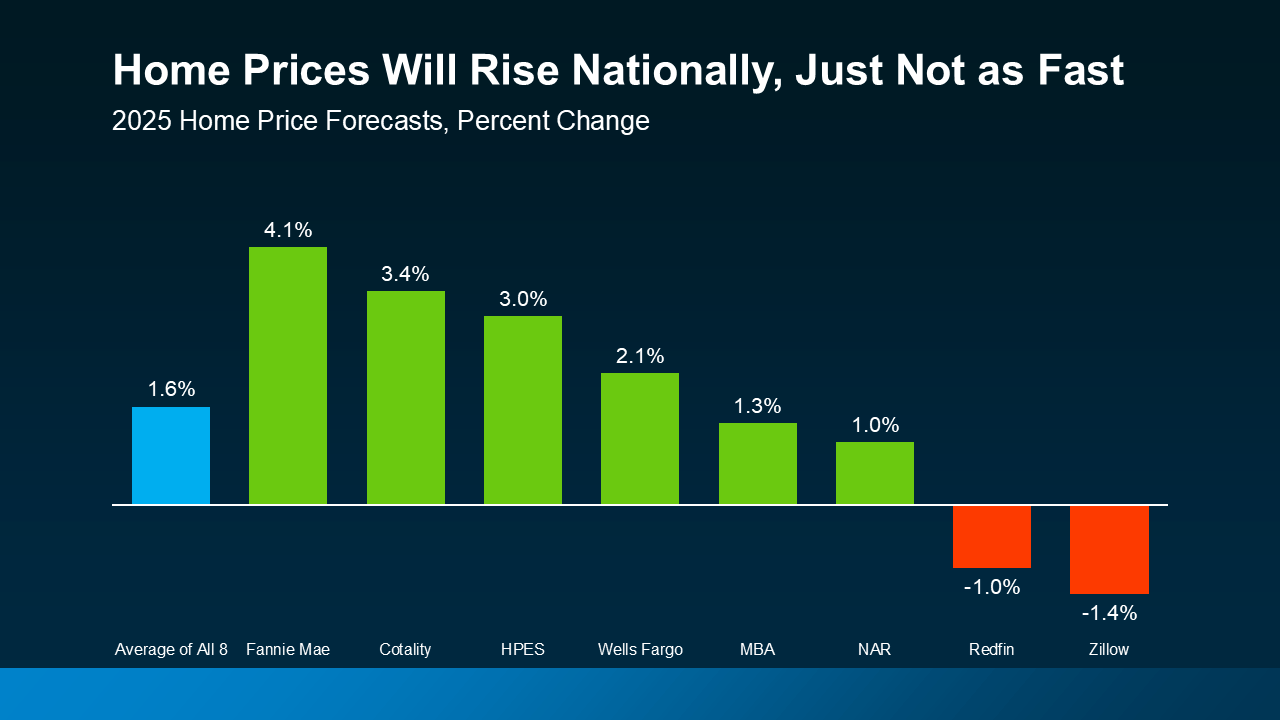

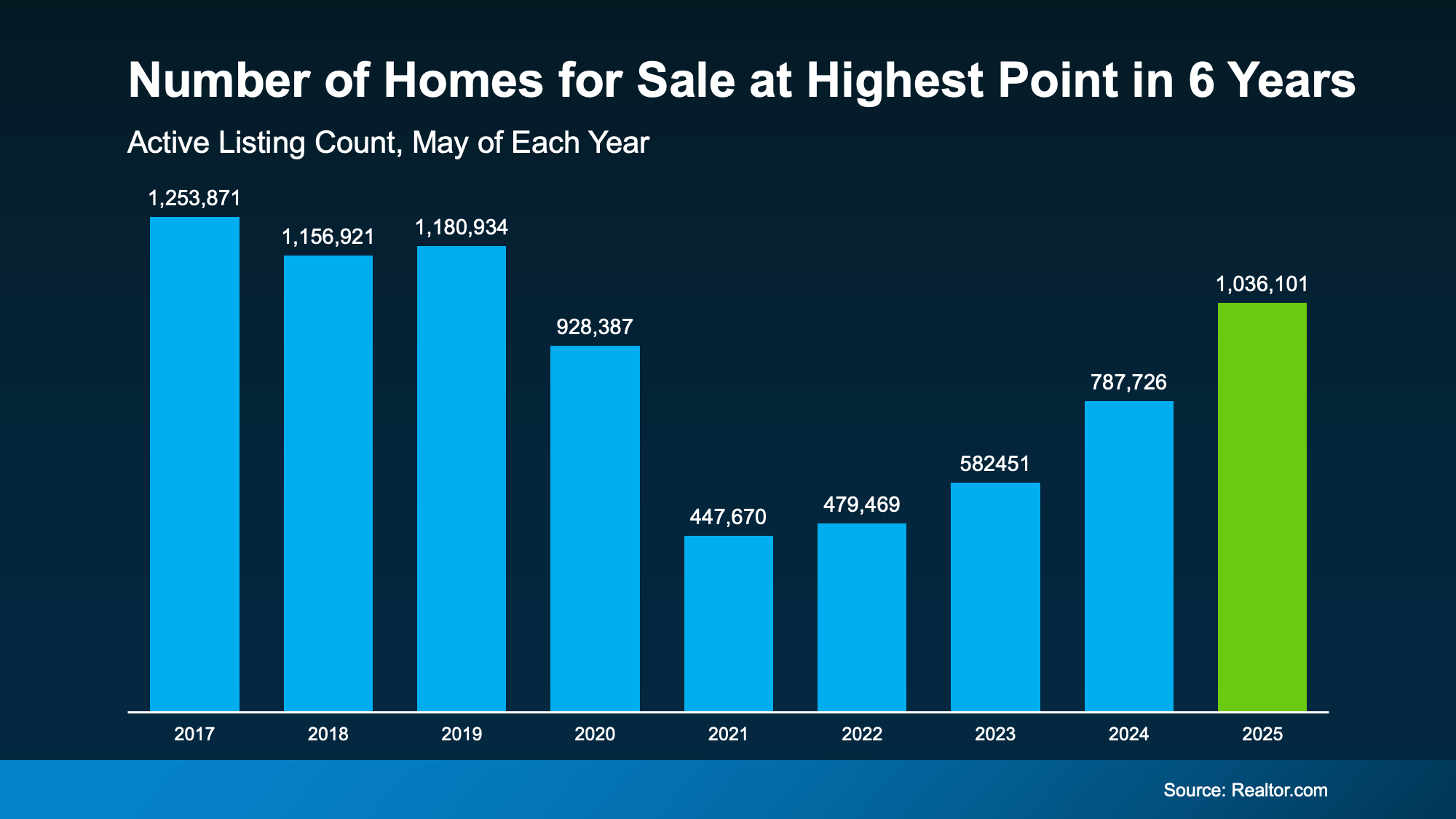

Housing Market Forecasts for the Rest of 2025

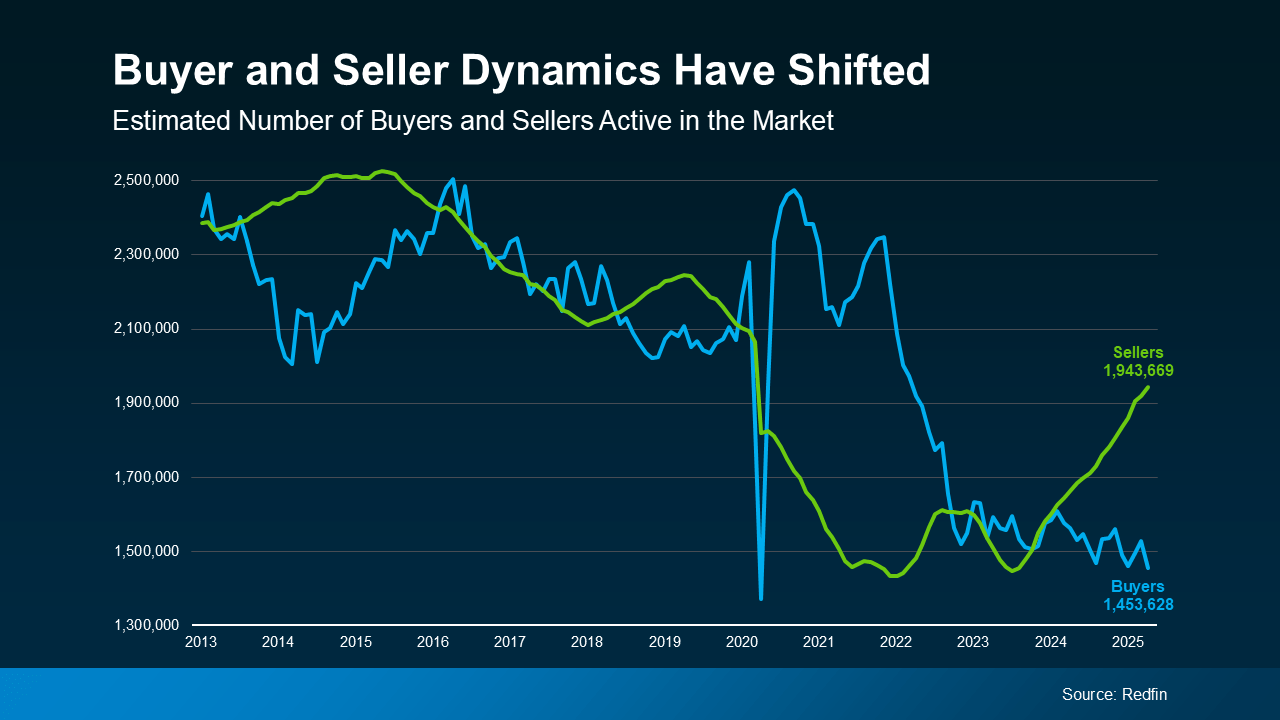

What Every Homeowner Needs To Know In Today’s Shifting Market

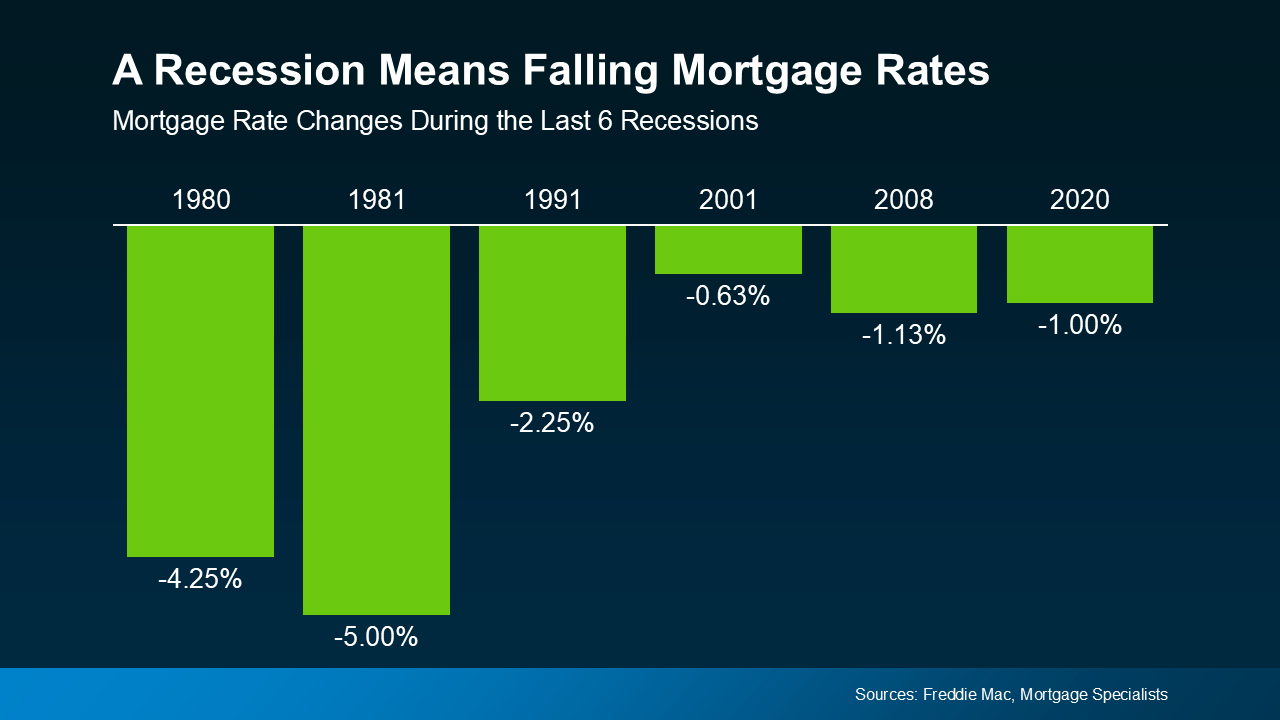

Think It’s Better To Wait for a Recession Before You Move? Think Again.

Why Your Home's Asking Price Matters More Today

Why Homeownership Is Going To Be Worth It

3 Reasons To Buy a Home This Summer

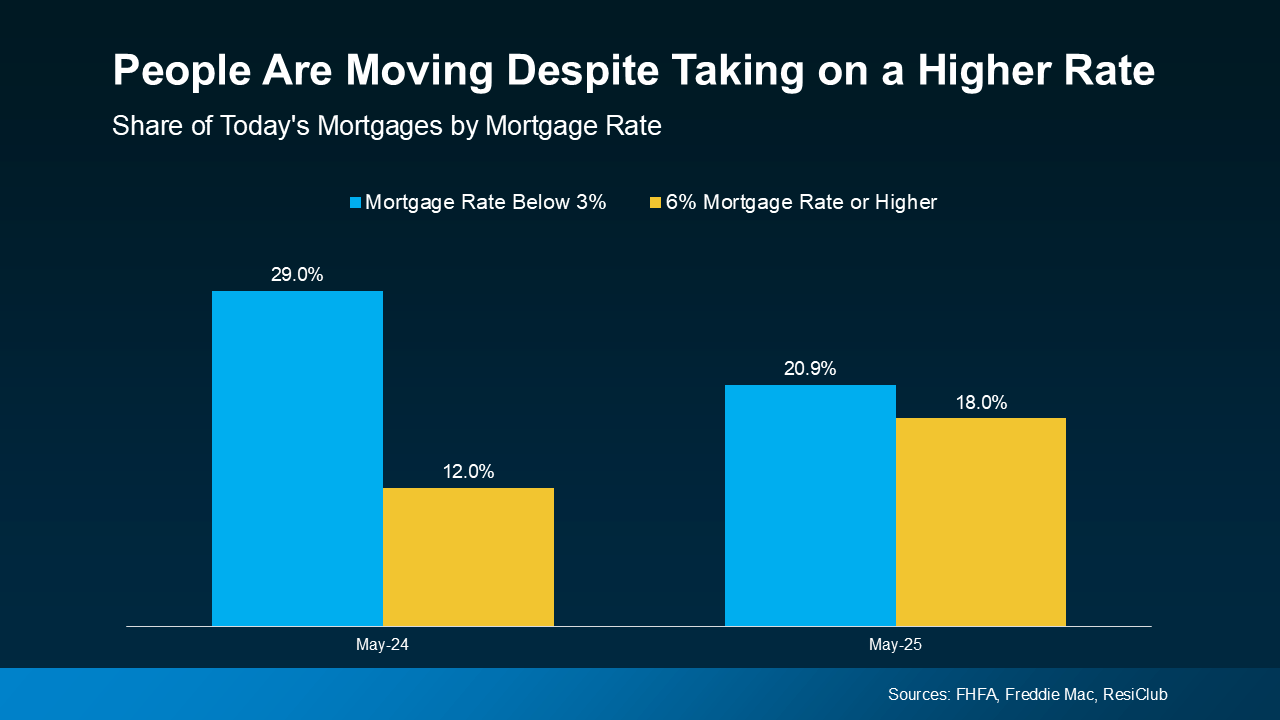

Why More Sellers Are Choosing To Move, Even with Today’s Rates

What You Really Need To Know About Down Payments

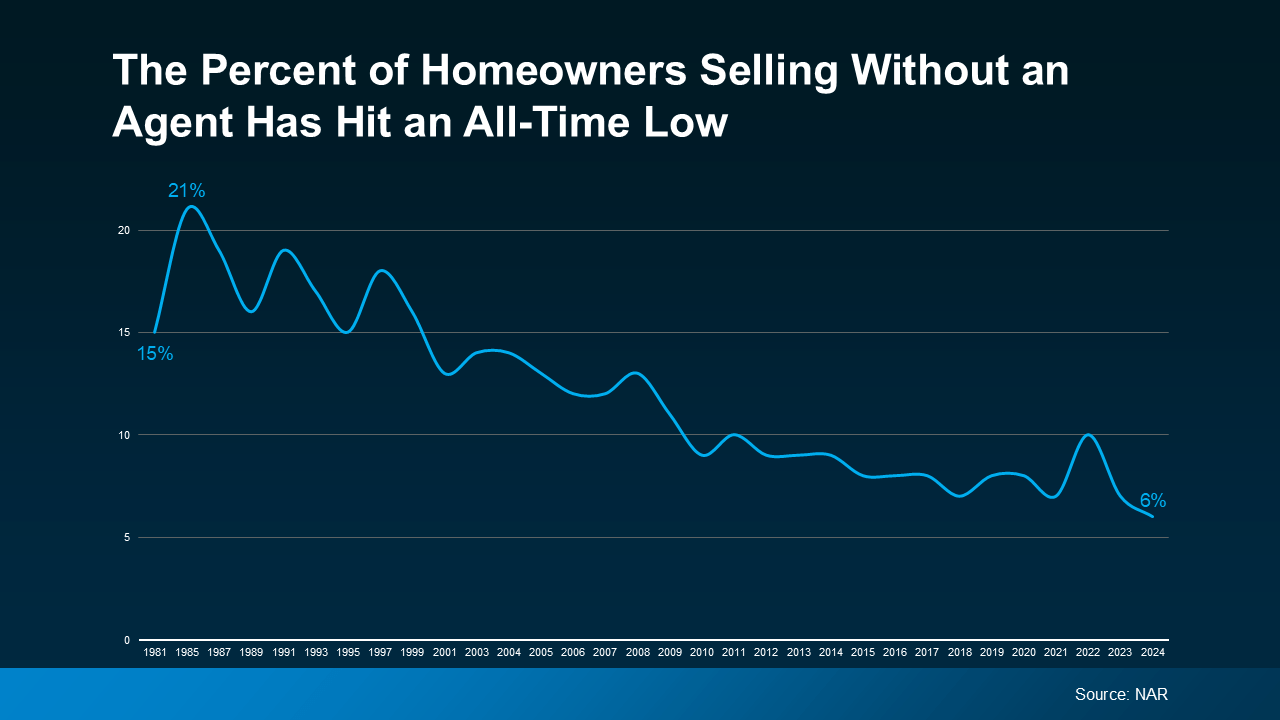

Why Most Sellers Hire Real Estate Agents Today

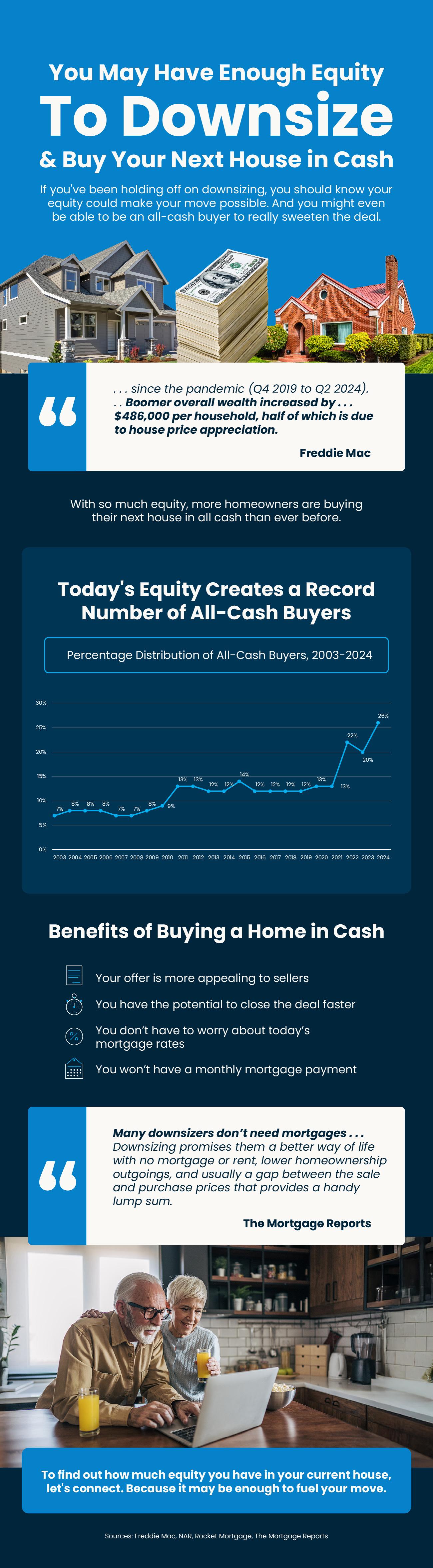

You May Have Enough Equity To Downsize and Buy Your Next House in Cash