What You Really Need To Know About Down Payments

Some Highlights

- There’s a misconception going around that you have to put 20% of the purchase price down when you buy a home. But the truth is, many people don’t put down that much unless they’re trying to make their offer more competitive.

- And if you want to give your savings a boost, look into down payment assistance. Most first-time buyers qualify and the typical benefit is $17,000.

- To learn more about your loan options or down payment assistance programs, connect with a trusted lender and check out downpaymentresource.com.

Categories

Recent Posts

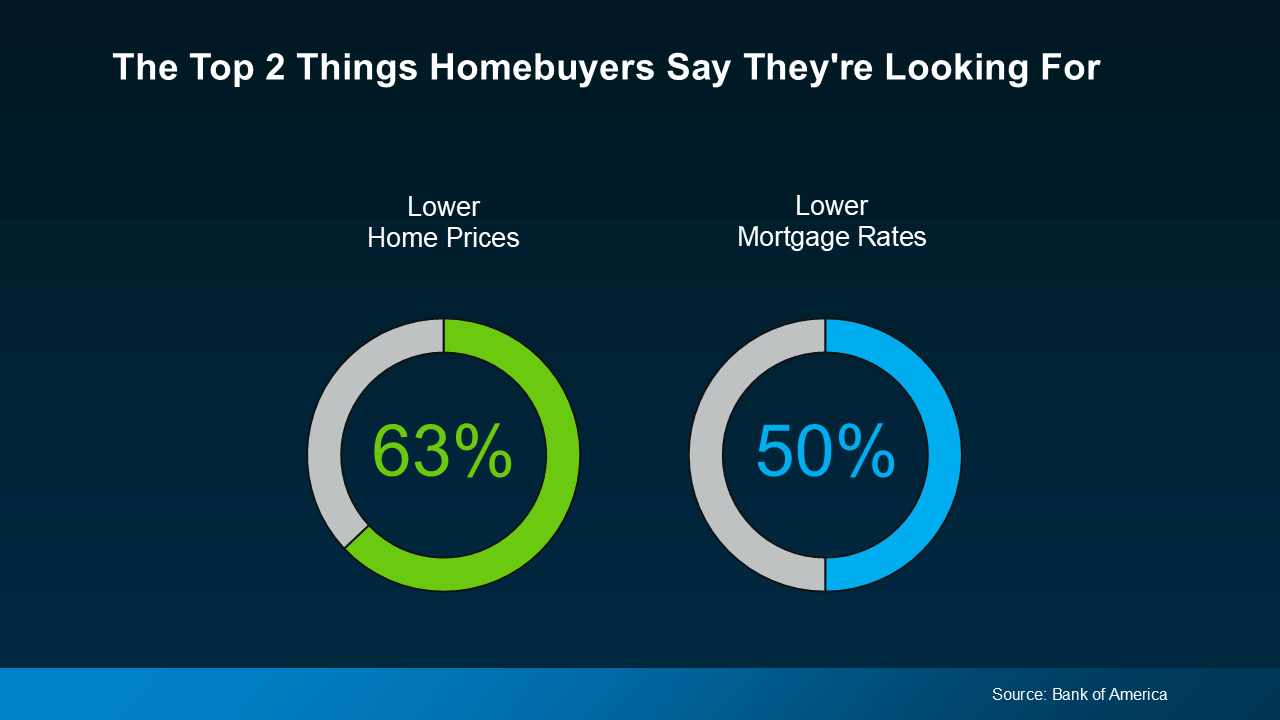

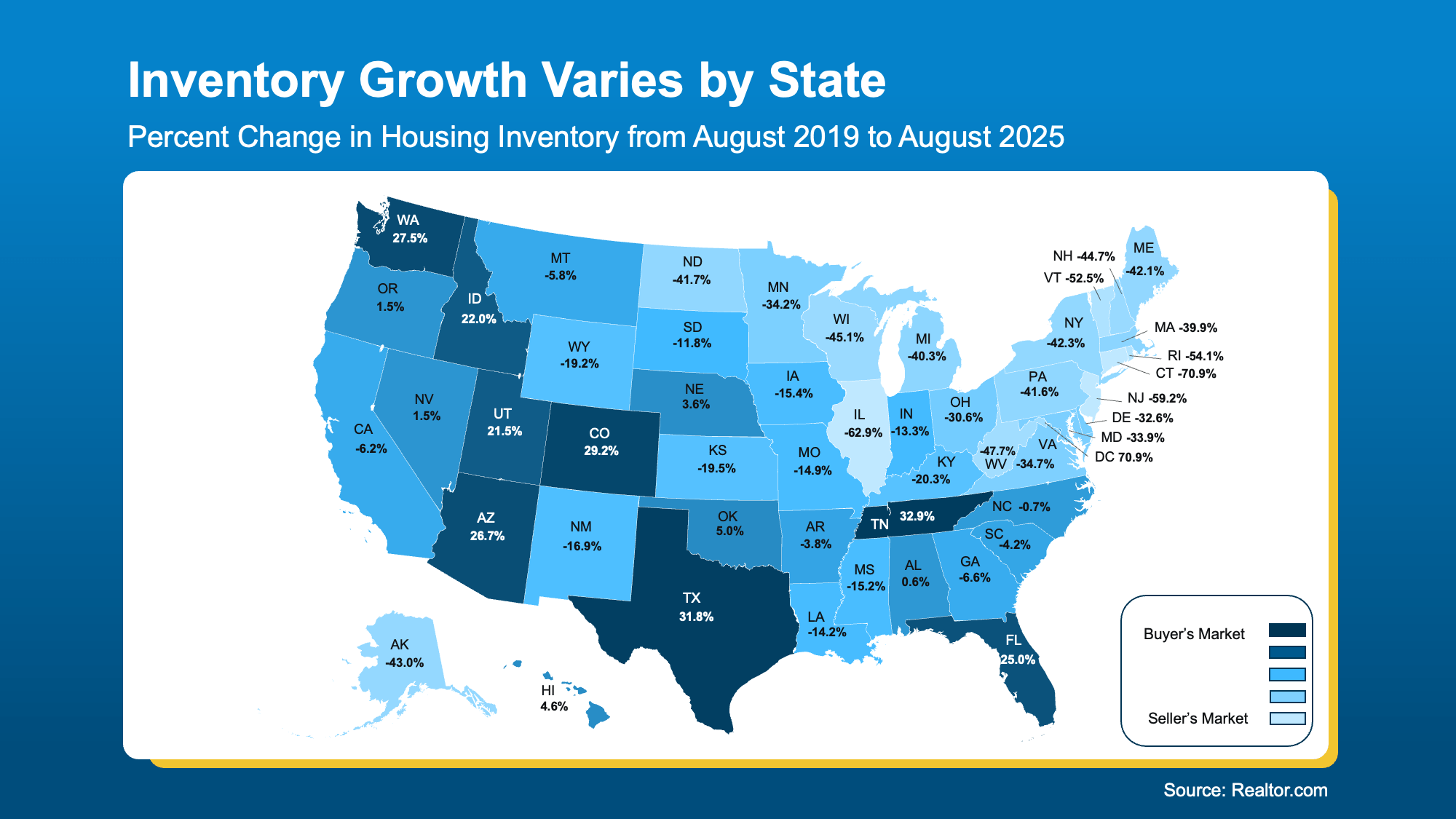

What Buyers Say They Need Most (And How the Market’s Responding)

Why Buyers and Sellers Face Very Different Conditions Today

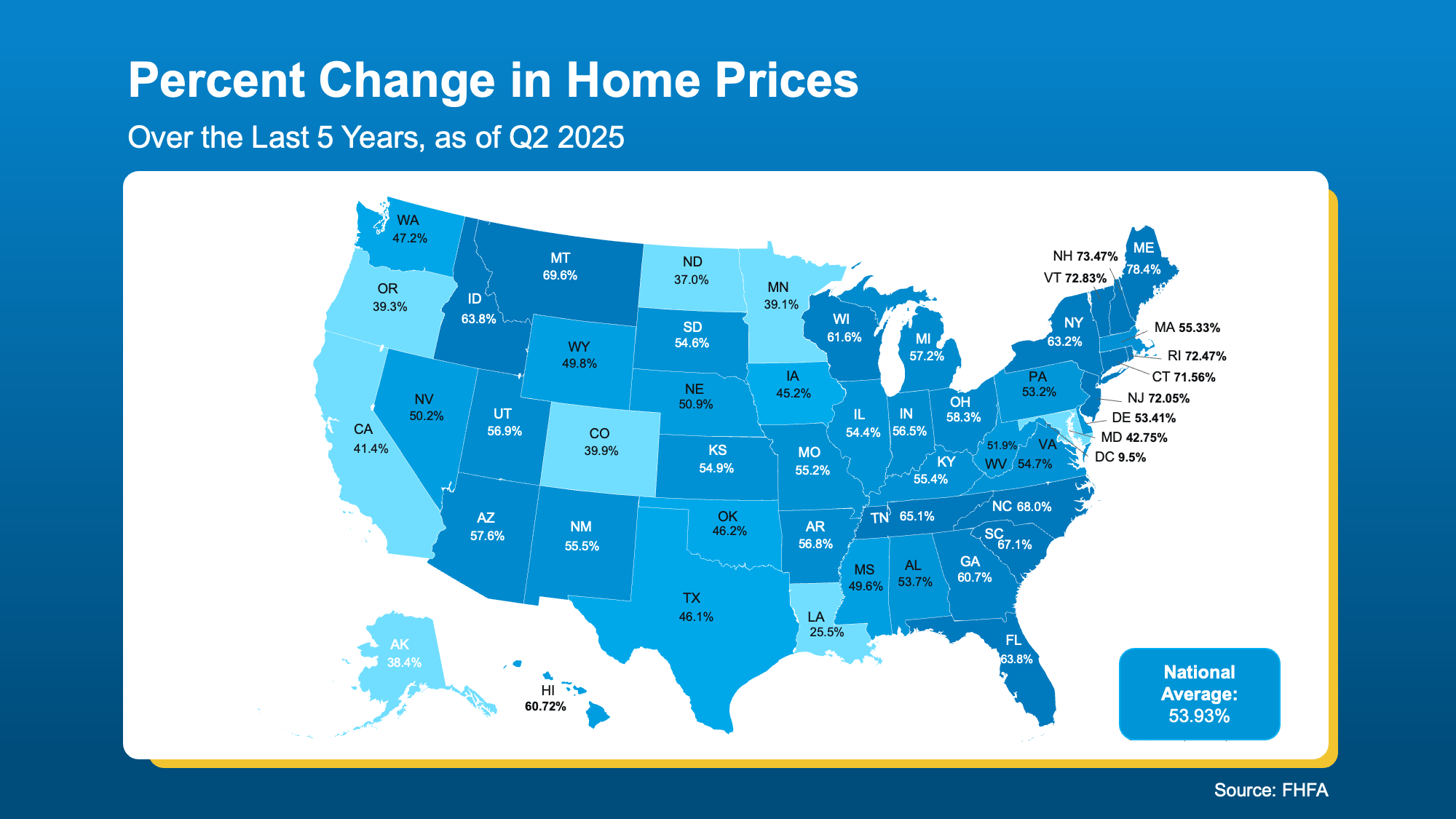

Do You Know How Much Your House Is Really Worth?

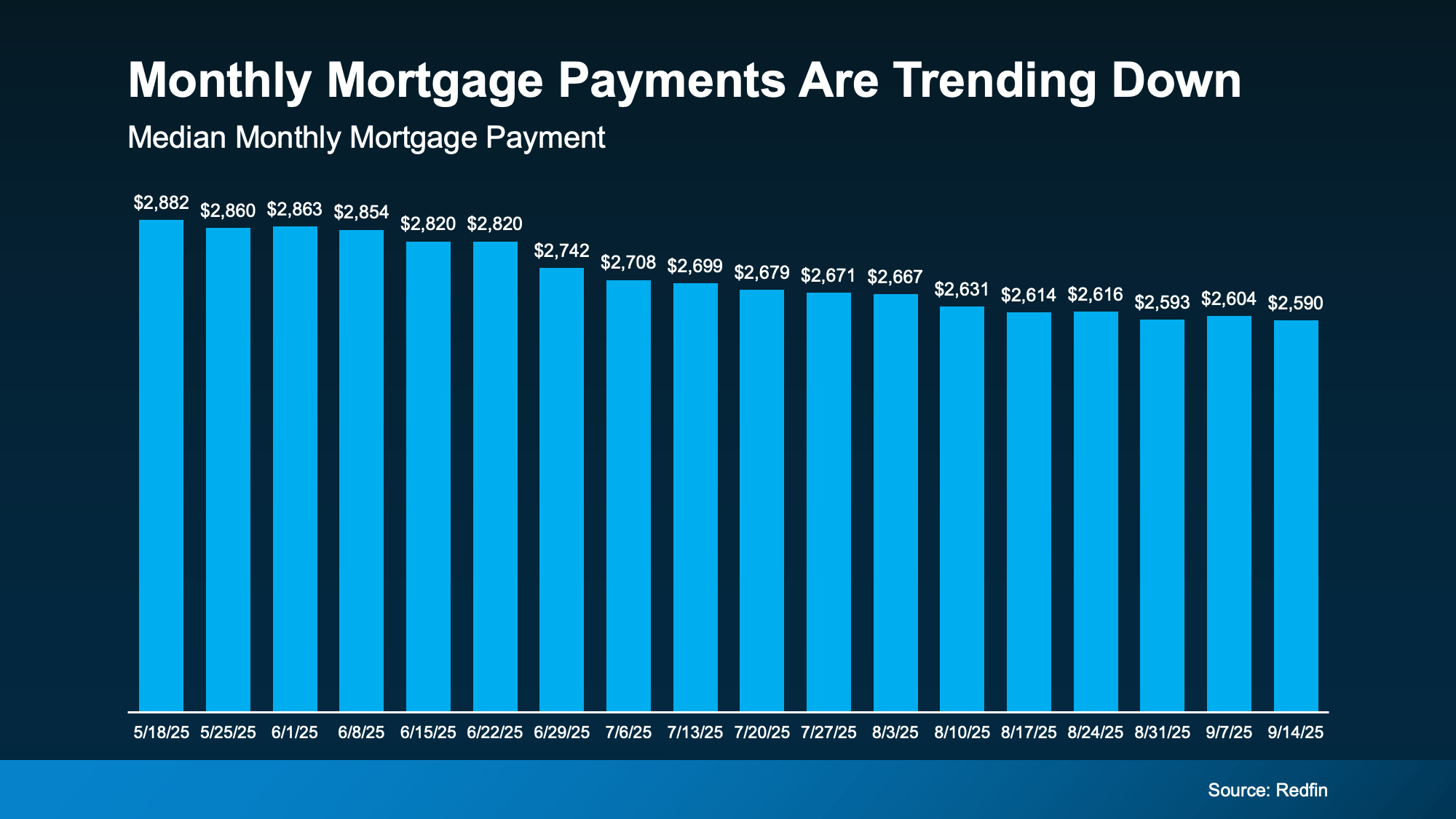

3 Reasons Affordability Is Showing Signs of Improvement This Fall

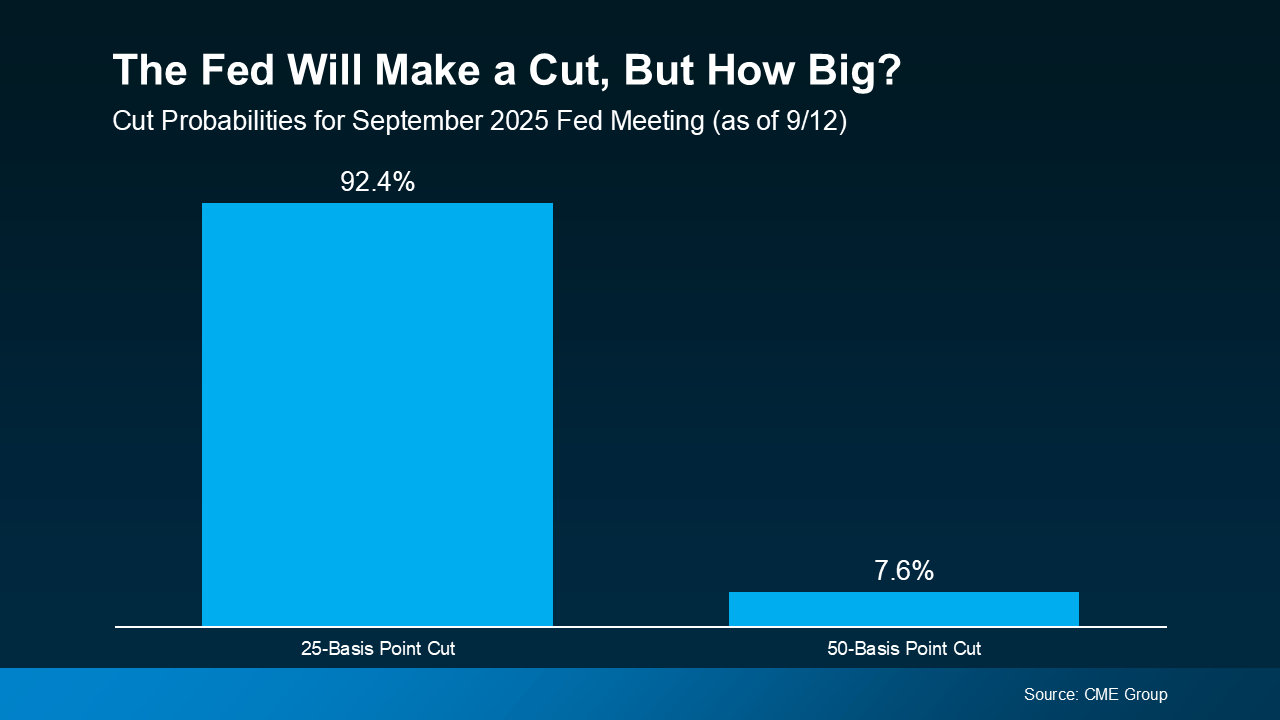

What a Fed Rate Cut Could Mean for Mortgage Rates

Patience Won’t Sell Your House. Pricing Will.

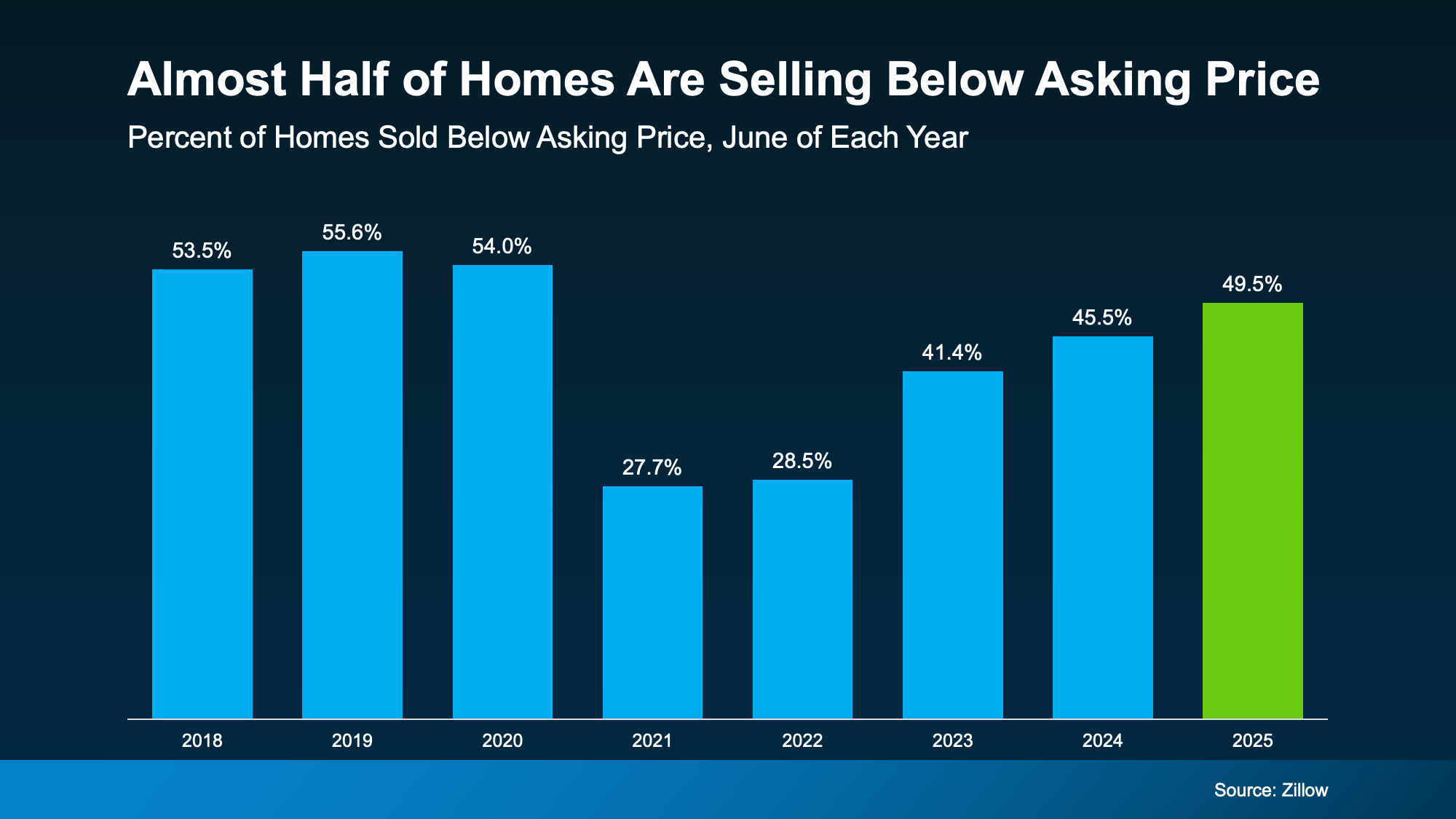

Why 50% of Homes Are Selling for Under Asking and How To Avoid It

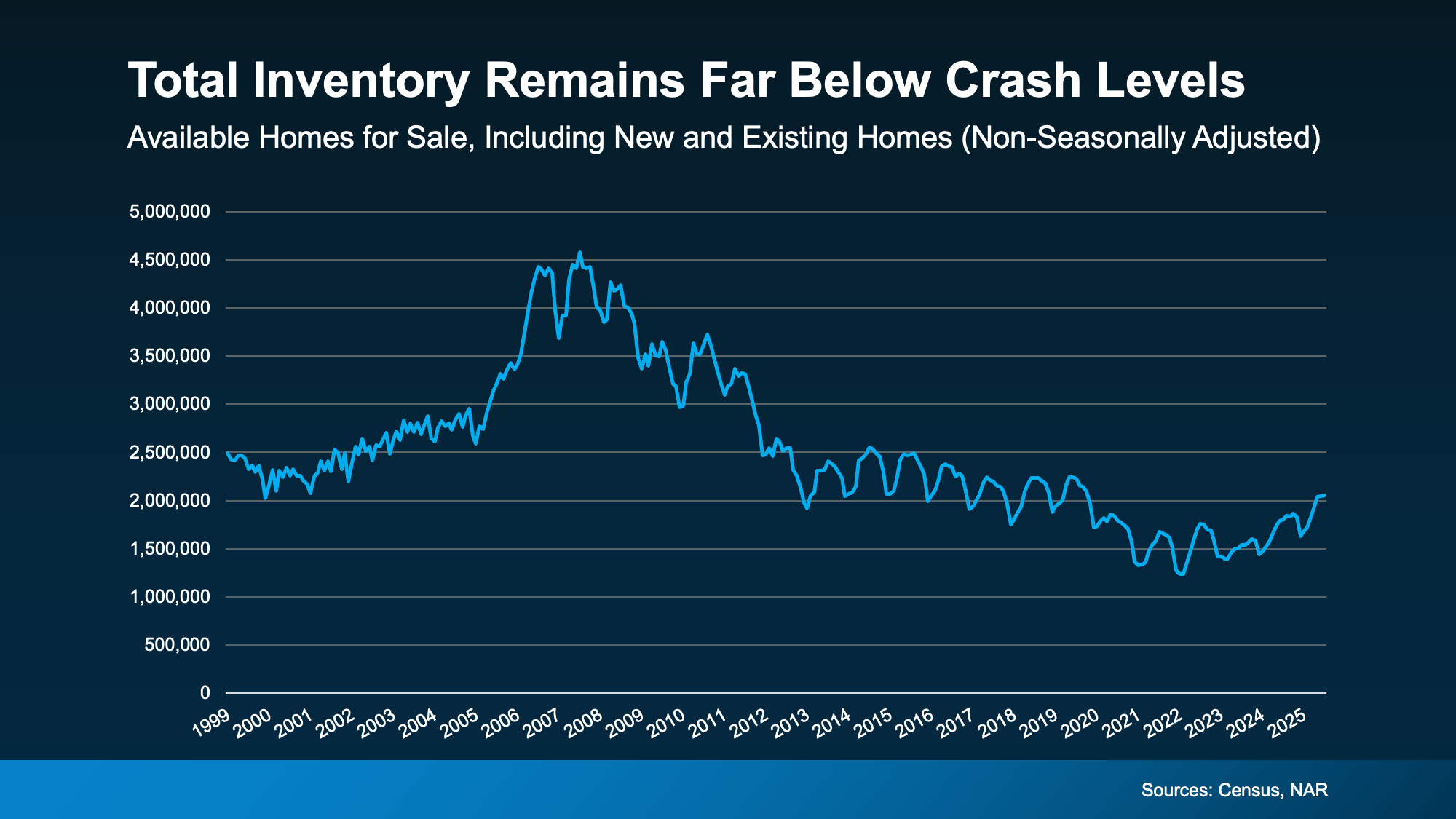

What Everyone’s Getting Wrong About the Rise in New Home Inventory

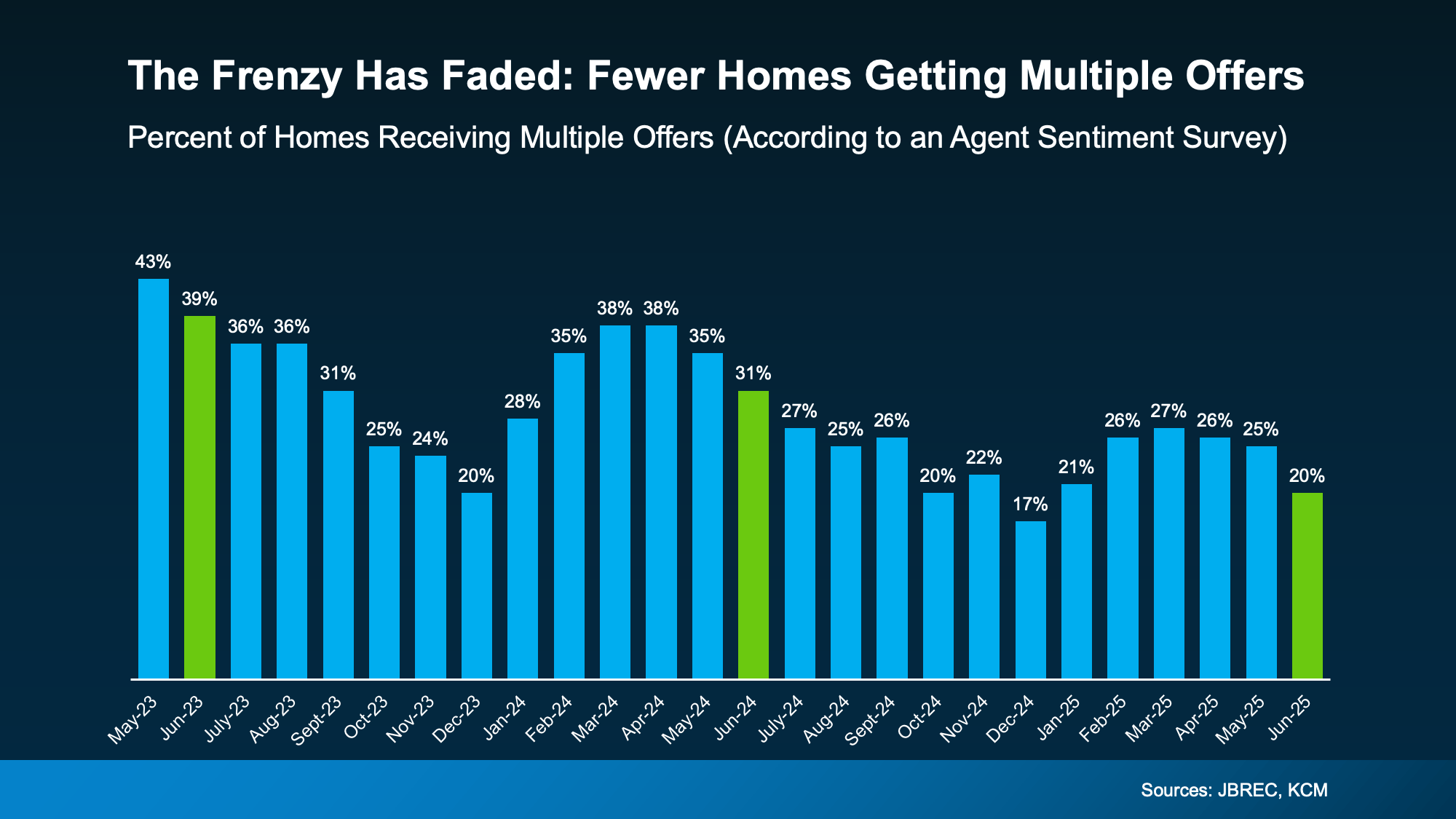

Should You Still Expect a Bidding War?

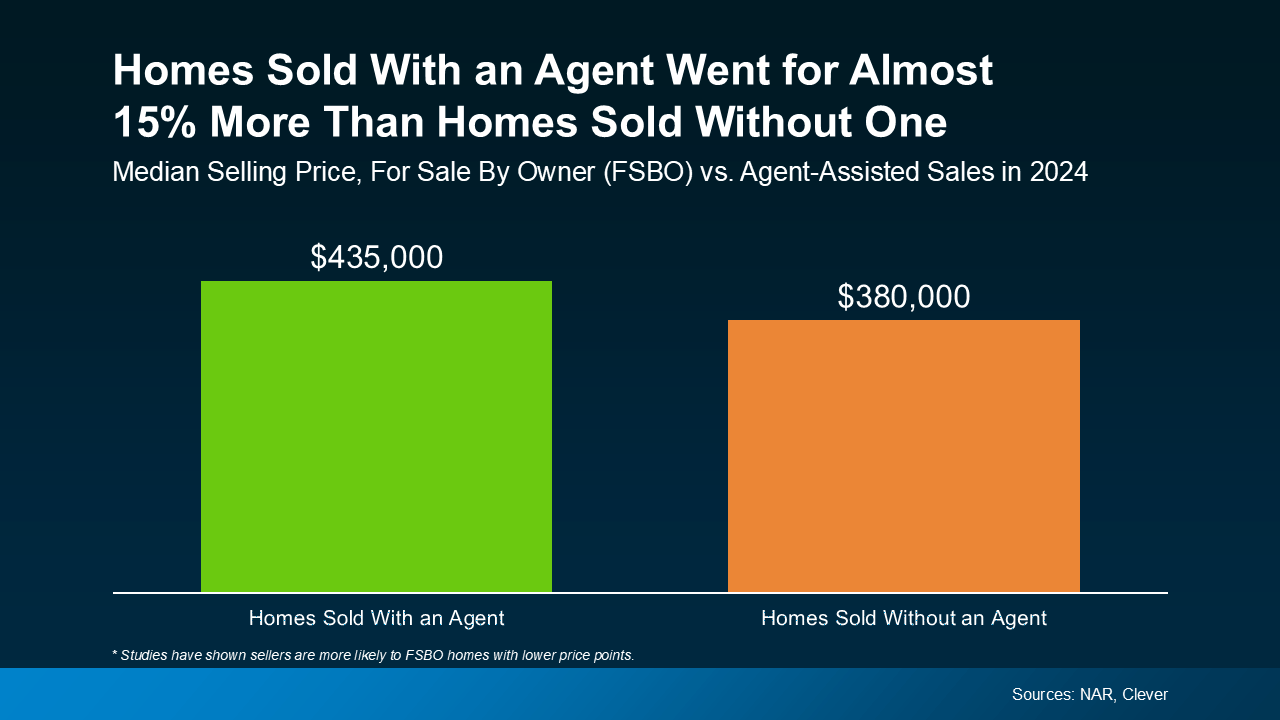

Why Selling Without an Agent Can Cost You More Than You Think